Share Personal Documents Here:

Client Portal Logins

Securely log in to your protected accounts through Camarda’s client portal or our custodian’s portal. Click the client portal you would like to access.

Camarda Portal

Orion Advisor Services

Custodian Portal

Charles Schwab & Co, Inc.

Financial Planning Software Available to Clients

Personalized Planning Tool

Money Guide Pro (MGP) is a fully customizable wealth software that lets you project finances visually and answer important questions. It’s easy to use and a great tool for prioritizing your goals.

» Click Here to Log In

…

First time logging in? Use the email you provided Camarda as your User ID, and select “Forgot your Password” to create your login.

overview of Money Guide Pro:

Personalized Planning Tool

MyBlocks is a fully customizable, simple, secure, online financial planning tool that breaks up key topics into easy-to-understand “blocks” to help you define financial planning needs for your future.

» Click Here to Log In

…

First time logging in? To create your login or hit “Register”.

overview of Money Guide Pro:

Recent Updates and Dr. Jeff’s Content Library

As a cherished client, you have full access to Dr. Jeff Camarda’s educational content library. And for your convenience, some of the alerts and updates that we share to our clients via email will also be easily accessible here:

Quarterly Market letter for Q2 of 2024:

Read key Updates on the Economy & Market Trends and an outlook for q3 of 2024

add this to your to-do list before the end of 2024:

The Corporate Transparency Act and Beneficial Ownership Information

Dr. Jeff Camarda’s Content Library:

Explore Jeff’s wealth ed content across multiple channels

This Week In Wealth:

Weekly videos from our team discussing market trends, sharing tips and messages to clients

Crash Courses:

Advanced wealth education videos | Complicated topics in a fun, fast, & understandable format

Your Dedicated Team

Lou brings nearly a decade of experience in Financial Planning. He graduated from Jacksonville University with a degree in Finance; started his Financial Planning career and obtained CERTIFIED FINANCIAL PLANNER designation in (his native) Canada. With Camarda, Lou brings vast experience in providing comprehensive financial planning services such as retirement, estate, and tax planning, asset protection, and investment management.

Blake, with just shy of a decade of experience as a financial planning practitioner, is driven by creating meaningful relationships with his clients. His professional focus is Wealth Optimization, which includes insurance, investments, cash flow, tax planning, and estate transfer. He brings a wealth of knowledge to our team and helps our clients make sound financial decisions.

As a vital link between client asset custodians and the firm’s financial advisors, Joyce plays a crucial role at Camarda Wealth as Portfolio Accounting and Trading Specialist. With over 30 years of experience, Joyce has been an integral part of the Camarda Wealth team since 1999, ensuring the accurate execution of Portfolio Board instructions, preparing customized client statements, and handling various trading and accounting functions. Known for her take-charge personality, she prioritizes fulfilling clients’ requests promptly, reflecting a commitment to doing right by those we serve.

Corey Oliver brings with him over 20 years of experience in the financial services industry with the last 12 years at Merrill Lynch where he obtained his SIE, Series 7, Series 66, and Series 24 licenses and held a variety of roles supporting Merrill’s Advisory efforts including operations, training, management, and sales. He graduated from the University of North Florida with bachelor’s degrees in political science and communications. Since joining Camarda this spring, Corey has already proven himself to be a dedicated, caring member of our team and brings valuable insight to our PWA team.

Deborah (Debbie) provides operational and administrative support to managers, PWAs, and the sales team. She has been an integral part of the Camarda team for the past five years, excelling in organizational tasks and communication in her previous role. Her commitment to excellence has been crucial to the efficiency and success of CWAG. She brings those skills and her 30+ years of comprehensive client service experience to this new role.

Whatever you need – Contact Us

For your convenience, our team shares an inbox that you can message anytime: clienthelp@camarda.com. It is our proud policy to follow up with all inquiries (phone or email) in ONE business day or less.

Message to Clients

Communication means everything to us.

Frequent phone calls with your Personal Wealth Advisor (PWA) play a crucial role in our communication strategy. Your PWA is your personal wealth concierge. They are always available to direct your planning on all things financial from Social Security claiming strategies, ROTH conversions, estate and asset protection planning, tax strategy, business and real estate questions, loan advice, college funding, and much, much more.

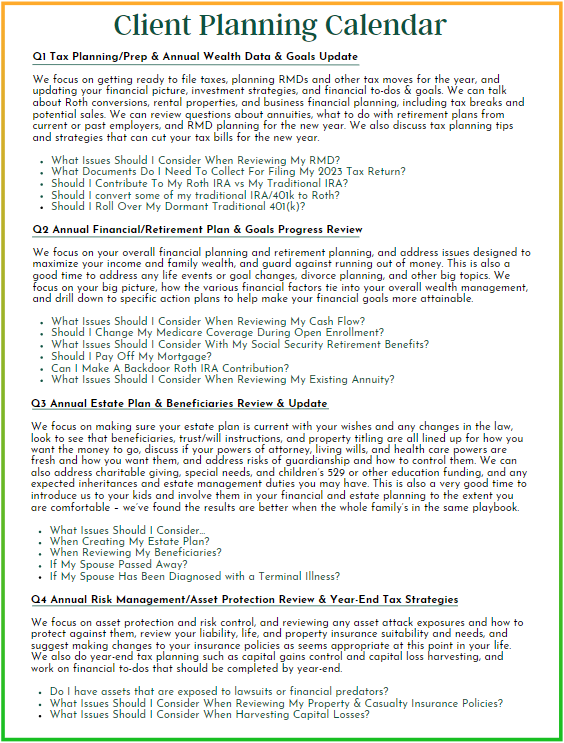

The Client Planning Calendar provided displays some of what may be covered during your check-in calls with your PWA. Use this as a guide for what to expect for upcoming calls, what documents may be coming to you soon, and what is going on behind the scenes at any given time of the year. View, download, and print at your convenience:

Our team-based approach designates the PWA as the primary coordinator for various tasks. Subsequently, Joyce Eason, our Senior Portfolio Accounting & Trading Specialist, leads her department in overseeing account preparation, monitoring, trades, transfers, statements, reports, and more.

Aside from regular phone calls, we often share interesting market forecasts and wealth education material to keep you updated with relevant current events. If you haven’t already, please provide us with the best email to reach you and make sure we are set to “not junk” or “not spam” in your inbox. Depending on your email provider, we hope these instructions prove helpful:

-

-

Outlook Email:

-

Open Junk folder, search “Camarda.” (typically at the top)

-

Right-click on each email address you find from us

-

Go to “Junk” or “Block” in the menu that appears and click “Never Block Sender.”

-

-

Web-based Email (Gmail, Yahoo, etc.):

-

Open Spam (or Junk) folder, search and select any email from “Camarda.” (typically at the top)

-

Select one of any of our emails and Click the “Not Spam” button, also typically located at the top.

-

-

In addition, you will receive our newsletter, which features in-depth market commentary, information on our portfolios and informs you of upcoming client events. Many of the features are written by the principals and advisors of Camarda Wealth Advisory Group, and we occasionally ask other professionals at the top of their field to share their thoughts and ideas as well.

If you’ll forgive the pun, our website hosts a wealth of knowledge as well. We encourage you to explore our INSIGHTS tab for our educational blogs, vlogs, and free reports. We also happily offer free copies of Jeff’s Latest Book, The Financial Storm Warning for Investors, if you’re interested. All of Dr. Jeff Camarda’s stockpile of educational content (and future content) is available to our clients for free and we encourage you to share it with your family and friends as well.

If you want to see a specific subject discussed, please let us know. Your opinions and feedback are appreciated.

At Your Service

Our Total Wealth Care™ Approach Means LOTS of Optional Services to Match Your Unique Needs

Our Approach: One quarterback, one team, one systematized, completely integrated wealth management process that goes beyond just investment management to align with all of your goals. Such as:

What matters to you, matters to us.

If you would like to discuss any of these services further, please reach out to your PWA or send a message with the button below.

Whatever you need – Contact Us

For your convenience, our team shares an inbox that you can message anytime: clienthelp@camarda.com. It is our proud policy to follow up with all inquiries (phone or email) in ONE business day or less.

FAQ for Clients

You should expect our uncompromising fiduciary loyalty and advice, driven by looking out for your best interests first and always. No commissions or hidden costs. Just fully disclosed fees structured so that the better you do, the better we do.

You can also look forward to a Total Wealth Care™ relationship, managed by a dedicated Personal Wealth Advisor (PWA) who knows you personally and reports regularly to you. Your PWA implements and updates your Portfolio Management Plan, runs your financial planning and long-term wealth plan, and coordinates the team for tax, estate planning, and other needs.

Your PWA is your personal wealth concierge. They are always available to direct your planning on all things financial from Social Security claiming strategies, Roth conversions, estate and asset protection planning, tax strategy, business and real estate questions, loan advice, college funding, and much, much more.

Check-in calls serve as valuable touchpoints to review your financial progress, address any questions or concerns, and discuss updates or changes in your circumstances. Your PWA will guide you through the agenda, ensuring that each call is focused on your financial well-being and goals.

As a guide throughout the year, this detailed Client Planning Calendar is a great resource that we encourage our clients to print out and save.

As a valued client, active communication is key. We encourage you to share your financial goals, concerns, and any changes in your circumstances promptly. Regularly reviewing updates and responding to inquiries from your dedicated Personal Wealth Advisor (PWA) ensures we align our services with your evolving needs. Your commitment to open communication allows us to provide the most effective and tailored financial guidance.

To update us on your address or contact information, please email clienthelp@camarda.com.

We also ask our clients to make sure they are not accidentally receiving our emails in a spam or junk folder. With technologies changing, this may be something to check periodically.

Depending on your email provider, here’s some instructions on how to remove us from junk or spam:

-

- Outlook Email:

- Open Junk folder, search “Camarda.” (typically at the top)

- Right-click on each email address you find from us

- Go to “Junk” or “Block” in the menu that appears and click “Never Block Sender.”

- Web-based Email (Gmail, Yahoo, etc.):

- Open Spam (or Junk) folder, search and select any email from “Camarda.” (typically at the top)

- Select one of any of our emails and Click the “Not Spam” button, also typically located at the top.

- Outlook Email:

Welcome to Camarda! During onboarding, you can expect a comprehensive introduction to our services. Your dedicated PWA will guide you through the process of understanding your financial goals, risk tolerance, and preferences. We’ll work collaboratively to gather necessary information and initiate the creation of a personalized financial plan. Our aim is to ensure you feel informed, comfortable, and well-supported from the outset.

During this time, please be sure to provide any potentially needed documents and share any and all personal documents using our secure upload link and don’t hesitate to ask your PWA questions or help along the way.

Life is dynamic, and so are your financial needs. If any changes occur, simply reach out to your PWA. They will guide you through the process of updating your information or refining your goals. Open and transparent communication ensures that your financial plan evolves in alignment with your current circumstances and aspirations.

Long before the investing world was rocked by the massive Bernie Madoff fraud, Camarda enacted protective protocols to safeguard clients’ accounts. Since our beginning in the 1990s, Camarda has protected accounts using institutional custodians like Vanguard, Fidelity, Schwab and TD Ameritrade. Accounts are always in clients’ names, never in Camarda’s. This is a very powerful barrier to protect your wealth from fraud.

Clients have 24/7 direct access to their accounts. You can check your values at any time, and move your money whenever you want. You can instruct these institutions yourself, whether to make changes, disburse funds, or even revoke Camarda’s management oversight instantly if you wish. Another substantial layer of protection comes from the very strong anti-fraud and other protection protocols these custodians utilize to assure that funds are accessible only to clients.

We have a published privacy policy that can be summarized as:

- We use physical, electronic, and procedural safeguards per Federal standards to protect clients’ nonpublic personal information.

- Our procedures are designed to secure confidentiality and protect against threats or hazards to the security or integrity of client records and information.

- Our policy restricts access to all current and former clients’ information to those employees and affiliated/nonaffiliated entities who need to know that information in order to serve the client.

- We will only disclose information to others if

a. You have authorized us to do so.

b. We are required to by law or regulation.

c. Such disclosure is permitted per federal and/or state privacy regulations. - We won’t sell or otherwise share your information with outside companies, marketing agencies, or others outside of our family of entities (such as The Family Wealth Education Institute, The Wealth Doctor, and Camarda’s TaxMaster as educational material is often shared between our affiliated entities). Read with full details on a Disclosures page about what we do and our company, such as ADV Form 2.

Our investment decisions are driven by two key principles:

- Targeting superior returns for income and portfolio growth, and

- Managing risk with a goal of avoiding losses in declining sectors or markets

We use a variety of disciplined investment methodologies, including fundamental and technical analysis. We believe in making decisions based on “what is” not “what should be.” Our approach considers current market conditions and integrates both economic data and actual price movements. We seek to remain nimble and yet disciplined in both up and down markets. We consider both top-down/macroeconomic, and bottom-up/sector & individual security perspectives, in decision-making.

This means if an asset class appears to be in an uptrend, we look to have exposure until the trend changes. If we decide the trend has changed, we look to get out and shift exposure to more promising classes, or to cash as a protective measure.

Where asset classes or entire markets appear to be in a downtrend, we seek to sequentially trim or eliminate exposure depending on our anticipated severity of portfolio impact.

We watch the markets on a regular, continuing basis, analyzing conditions and standing ready to move quickly when appropriate.

Camarda portfolio decisions are made by our Portfolio Management Board, as led by our Chief Investment Officer, who Chairs that Board. Collectively, the Board has many decades of experience and is extensively credentialed, including Ph.D.s and CFA®s.

We use a highly customized approach designed to incorporate:

- Your portfolio growth & family wealth goals

- Income needs across the timeframes of your planning horizon

- Tax control considerations

- Your total financial picture – not just the part we manage

- Your investment preferences and instructions

- Your sensitivity and concerns about risk

As part of our Full-Service Financial Planning, we develop a custom Portfolio Plan for each client, based on a personalized Investment Policy Statement for your family. We custom craft each portfolio, blending from our menu of proprietary Camarda strategies, in a full discussion with you.

We also incorporate any specific preferences you have, including advising on existing positions you don’t want to sell for tax or other reasons. Unlike most advisors we know, we can even manage your current 401ks, without you leaving the plan or having to move assets out. We’ve even built similar systems for 529s, no-commission annuities, and other “hard to manage” investments.

And as a new client, we won’t change or do a thing to your existing investments until you fully understand and give us the green light to begin managing your accounts according to the agreed upon plan. Once set up, we regularly discuss and adjust as you, and the world, change.

Our fees are based on the value of your managed assets and designed to help align our interests – the better we do for you, the better we do.

Our fees are fully transparent – what you see is what you pay. This is quite different than other advisors. The difference is we tell you what we charge, while others’ total costs may be hard to spot. More importantly, we have no incentive to recommend one investment over any other – our only objective is achieving the best portfolio for you.

Many advisors are “fee-based” – where you pay an obvious fee but also hard-to-spot internal product costs & commissions. Many more are pure commission, which can look cheap or even free, but whose actual costs – buried in mounds of legalese disclosure – can cost much more than Camarda’s clear and transparent fees. They can also motivate an advisor to recommend what makes them the most, not what is best for you.

Our standard fees cover Full-Service Financial Planning, not just investments. Also, unlike the vast majority of advisors, we are true fee-only fiduciaries, and accept no commissions or other incentives on our recommendations. Our advice is solely based on what we think is best for you, without the conflicts of “kickback” compensation. If you’d us to resend our agreement or have any questions, please contact your PWA.

The Family Wealth Education Institute – FWEI – was founded by Dr. Jeff and partner Kim Camarda. Its mission is to provide astute wealth education and techniques to the public at large, including Camarda clients.

The Camardas formed FWEI to promote better wealth education for America’s successful families, whom they found too often tragically overpaid taxes, were misadvised on an estate and asset protection planning, and misled by poorly trained, non-fiduciary advisors on investment, insurance, and other high-wealth matters.

FWEI offers a catalog of online courses via its wealthmasterclass.org website. These classes and other FWEI resources are freely available to Camarda clients.

TaxMaster offers non-SEC-defined wealth management advice and services. In other words, it provides non-securities-investment wealth management advice.

This includes estate and asset protection planning, tax optimization strategies, tax return preparation, business, asset protection, estate planning, entity setup, and the development and execution of legal documents like trusts.

TaxMaster is a shared owner affiliate of the Camarda Wealth Advisory Group but separate from investment advisor Camarda Financial Advisors for regulatory reasons, and to respect and accommodate the separate prerogatives of the SEC and IRS. Functions are highly coordinated to help deliver on Camara’s Total Wealth CareTM/one-stop value proposition. TaxMaster fees – typically for tax research, tax returns preparation, legal documents, and entities structure execution – are separate and distinct from Camarda’s. TaxMaster’s team includes Ph.D.s, CPAs, attorneys, & admitted Federal tax practitioners.

More info on TaxMaster can be found at TaxMaster.US

Camarda believes portfolios should not only be grown. They must be preserved. If you’re like most of our clients, you believe that returns are important, but that avoiding big losses is even more important. Enjoying a lifetime of accumulations, only to face an extended, value-crushing bear market in or near retirement, can be devastating. Camarda uses active management as both a risk control and return enhancements measure.

We watch the markets closely and are prepared to move quickly should we deem it prudent. This approach is quite different from the buy-and-hold dogma that you’ve likely experienced from a previous advisor. While “don’t worry, it always comes back” beliefs have become entrenched, the reality is that some market upheavals can be life-changing, and many buy-and-hold strategies may never recover from them. Getting out of the way can mean the difference between building serious, long-lasting wealth, and merely scraping by… or not being able to. Our proprietary strategies are designed to participate richly in market returns but get out of the way of market meltdowns. This is one of many key Camarda differences compared to other advisors and could make all the difference to your quality of retirement.

Camarda provides investment advice we think you’ll find refreshingly customized and tailored for you. Personalized, communicated, and quaterbacked by your PWA and a dedicated, highly-educated, coordinated, and adequate advisory team.

Some advisors say they don’t use “cookie cutter” portfolios, but on inspection, most of their client accounts look the same. Some even use their own branded mutual funds. These can be hard to get total cost data on but may cost you more as they’re potentially more profitable for them.

Others use Turnkey Asset Management Programs that “let financial professionals and firms delegate asset management and research responsibilities to another party that specializes in those areas.”* Not only are such advisors not actually managing the investments, but such arrangements can layer on two, three, or more additional layers of hard-to-find fees. These are often “white-labeled,” meaning “when a product or service removes their brand and logo from the end product and instead uses the branding requested by the purchaser” so the third-party advice looks like it’s coming from the advisor.

Not Camarda. We custom-craft individual client portfolios using an extensive palette of proprietary strategies available nowhere else. This gives us a remarkable degree of precision to tailor portfolios to control risk, target robust growth, and generate income based on your personal needs and preferences.

We go beyond and are happy to advise on your existing portfolios without the need to cash all in to use one of ours. This capability can be extremely valuable from a tax and legacy perspective. We can also manage your 401ks in place at your existing employer, a feat it seems most other advisors have not figured out.

Camarda’s Portfolio Management Board is run by experienced portfolio managers with highly recognized industry-credentialed expertise. We use active management and risk control to target attractive returns while working to avoid losses.

And we are led by principals who invest their own family wealth the same way they invest their clients’. We think you’ll find Camarda offers expertise far beyond what you can find elsewhere.

*Turnkey Asset Management Program (TAMP): Definition and Types https://www.investopedia.com/terms/t/turnkey-asset-management-program-tamp.asp

Don’t keep us a secret! We appreciate your loyalty and trust. Please refer friends and/or family to Camarda, and they can experience The Camarda Difference that you’ve come to value. Here are some links to share a little bit about us: Our introduction video and our website’s INSIGHTS tab. And if you want to directly refer someone to us, please do so through your PWA.