Can You Still Retire with More Than Enough?

When most folks worry about retirement, the biggest concern seems to be having enough money to sustain their current lifestyle. Big concerns and questions like,

Will my assets be sufficient to supplement income sources like pensions and Social Security?

Will I outlive my money?

Will my investment returns keep up with inflation?

What will be left for my kids?

Retirement planning is one of the very most important and complicated financial planning disciplines. It’s also one of the least understood and most poorly executed. This can be tragic.

Finding a retirement “plan” is easy. Advisors galore generate colorful pages by the pound. Such plans often suffer from too little thought and analysis. They frequently promote a commission sales agenda that puts your interests last and your retirement at risk.

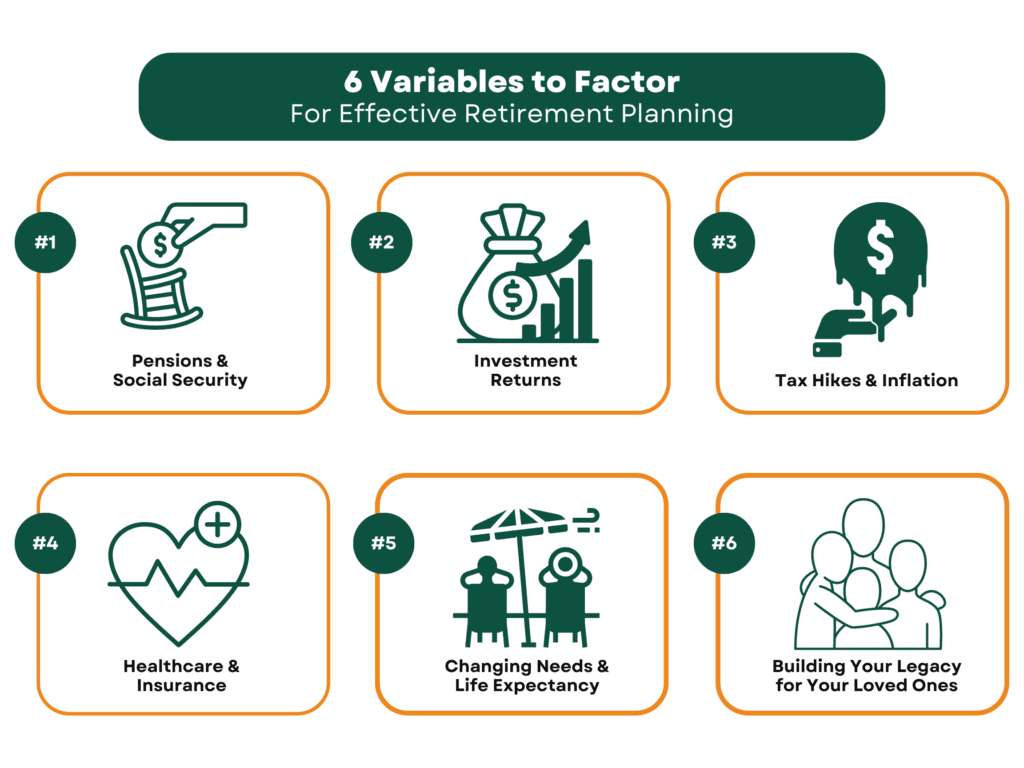

There are many variables to factor in. Pensions and Social Security. Investment returns. Tax hikes. Inflation. Changing wants and needs as one ages. Soaring health care costs, Medicare restrictions, and supplemental insurance costs. Life expectancy. Leaving a surviving spouse properly provided for. The legacy you wish to leave behind.

Projecting, updating, and managing these changing factors to provide enough income to stay comfortable and healthy, yet not run out of money whether you live a long time or not, can be extremely challenging.

Get the planning wrong, and the shortcomings can be tragic. If you are in or near retirement, risks of running out of money may be high but hard to see.

“Effective retirement planning is much more complex than it looks. Finding a smart retirement plan can be extremely difficult.”

Let us help you do retirement planning right. We’ll make it easy to understand and balance the many critical factors and help you plan and live the retirement you really want.

401(k), 403(b), TSP & other Retirement Plan Rollovers

When do Rollovers to IRAs Make Sense?

When people change jobs or retire, one of the biggest challenges is deciding if it’s smart to rollover your 401(k)-type plan to an IRA. The “roll 401(k) into IRA” process is fast and easy, but you may be looking for an advisor like Camarda who knows how to mange your 401(s) without triggering rollover. Making the best choice can be very complex.

Get it right, and your retirement can be very bright indeed.

But make the wrong choice, and you face some big risks. These include running out of money, not being able to afford health care, & leaving a surviving spouse below the poverty line.

While 401(k)s are very common, the important decision applies even if your employer retirement plan goes by a different name.

Do any of these apply to you?

- 403b rollover to IRA?

- TSP rollover to IRA?

- FRS rollover to IRA?

- DROP rollover to IRA?

- 457 rollover to IRA?

- TSA rollover to IRA?

- Pension lump sum rollover to IRA?

- Cash balance plan rollover to IRA?

- Retirement buy out rollover to IRA?

FAQs

The best decision on your 401(k) rollover or other plan may not be obvious, but could not be more important. It’s a real fork in the road.

Getting the 401k IRA choice right can lead to a luxurious retirement.

Getting it wrong can lead to hard choices and misery.

Using an advisor to guide the choice can a great help, but be careful. Many advisors offer to transfer a 401(k) to IRA or give other 401(k) advice, but may not be fiduciaries required to act in your best interest. Others may not have enough training to help you make the best decisions for a secure and comfortable retirement.

Finding an objective and qualified advisor can be hard, but worth it.

Even if you think you want professional guidance, moving money from your 401(k) to IRA may not be the best advice. Besides simply “moving 401(k) to IRA” you may want to consider options, such as:

In-the-know advisors like Camarda can actually manage your 401(k) right in the old plan, without needing to do a rollover. Ditto for 403(b), FRS, or other employer retirement plans. This can avoid the need for rolling over, transferring, or moving money from your new or old 401(k) to an IRA.

This can be done with virtually any plan, but it takes some research to figure it out. Many advisors are not set up to do this, but Camarda is.

Is a 401k IRA rollover the best thing for you? Should you leave it in the old plan? Should you do a rollover to a new plan? Take our quick assessment to find out!

Finding a good, objective financial advisor can help you make better decisions and improve your wealth outcomes.

All advisors are not created equal, so be careful.

Many advisors may offer to transfer a 401(k) to IRA or give other 401(k) advice, but often are not fiduciaries required to act in your best interest.

Others may not have enough training or resources to help you best.

Quality advice can be important to help you make the best decisions for a secure and comfortable retirement.

For instance, doing an indirect rollover instead of a direct transfer – a common mistake – can cost thousands in needless tax. It can also create a cash crunch when you can afford it least. Unsophisticated advisors can inadvertently trigger problems like this.

Some may offer only a robo advisor experience. This may not make for one of the best places to rollover your 401k. Many don’t offer hands-on managed account. This can leave you with only a self directed account or self directed IRA.

Remember – getting the 401k IRA choice right can lead to a luxurious retirement. Getting it wrong can lead to hard choices and even misery.

A skilled, objective advisor can speed you there, but the wrong advisor can set you back a lot.

Deciding if and how to roll your 401k is a very important decision. There are many factors to consider, which are summarized below. To simplify these factors specifically to your needs, we encourage you to schedule a Free Discovery Call.

Reasons to Consider

Doing a Rollover, Transfer, or Move Your 401k &/or Other Plan(s)

You are unhappy with your investment performance

- Poor advice, high costs, and limited choices can stall profits

- Could you make more with the right rollover choice?

You want more or better investment choices

- Many plans limit your investment options

- This can restrict diversification, increase risk, and hinder returns

- Could the right rollover give you better investment choices?

You want access to better professional advice in your best interest

- Many plans don’t offer fiduciary investment advice or financial planning

- The right fiduciary advisor can help make better choices to grow wealth

You want the option to convert to a tax-free ROTH and your plan does not permit this

Your plan has high investment expenses that are not obvious to you

- Fees can be hard to spot. If you’re not sure, click on the free assessment to apply for a no-charge analysis

- In many cases, rolling a 401k to IRA can actually reduce costs or produce higher levels of financial planning advice for similar cost

401k-type plans are controlled by your ex-employer not you

- Transferring your 401k to IRA can offer more control and access

You want to consolidate accounts for simplicity and coordinated management

- 401ks can be cumbersome even before you leave, and worse after

- The right rollover can simplify your life

Reasons to Consider NOT

Doing a Rollover, Transfer, or Move Your 401k &/or Other Plan(s)

You are sure you have a truly inexpensive plan with broad investment options

You already get ongoing fiduciary financial planning, update calls, and custom advice

You get broad advice on insurance, estate planning, education planning, taxes, etc.

Loans remain available after termination and this matters in your situation

Why Choose Camarda Wealth to Help with the 401k Rollover to IRA Decision

In a field where true expertise and professionalism can be very hard to come by, Camarda has invested decades in education and expertise. We’ve done this for one reason – to be a better resource for investors.

Our exclusive WealthMax™ 401k rollover system was designed by our own award-winning Ph.D. in Financial and Retirement Planning. WealthMax™ can bring you keen insight into your best path on 401k rollover, 403b transfer, and other IRA rollover decisions. To learn more, get started below.

Get Insight On Your Specific Needs