Taxes Saved is Wealth Earned

Saving avoidable taxes can be one of the most powerful ways to accelerate and protect personal wealth. Knowing how to convert legally avoidable taxes to family wealth is like turning lead into gold.

Forbes says a whopping 93% of business owners overpay their taxes.* Even the Feds admit that businesses overpay some $50 billion dollars a year, with overpayments of a billion or more a year potentially stretching back for decades. David Ramsey says “Every year, more than 2 million taxpayers overpay their income taxes—and we’re not talking about pocket change.”

Kiplinger’s suggests poor tax preparer training & CPA ignorance and laziness is responsible for wasting countless wealth to avoidable taxes. Many investors feel their financial and tax advisors don’t work hard and smart enough to save every possible dollar.

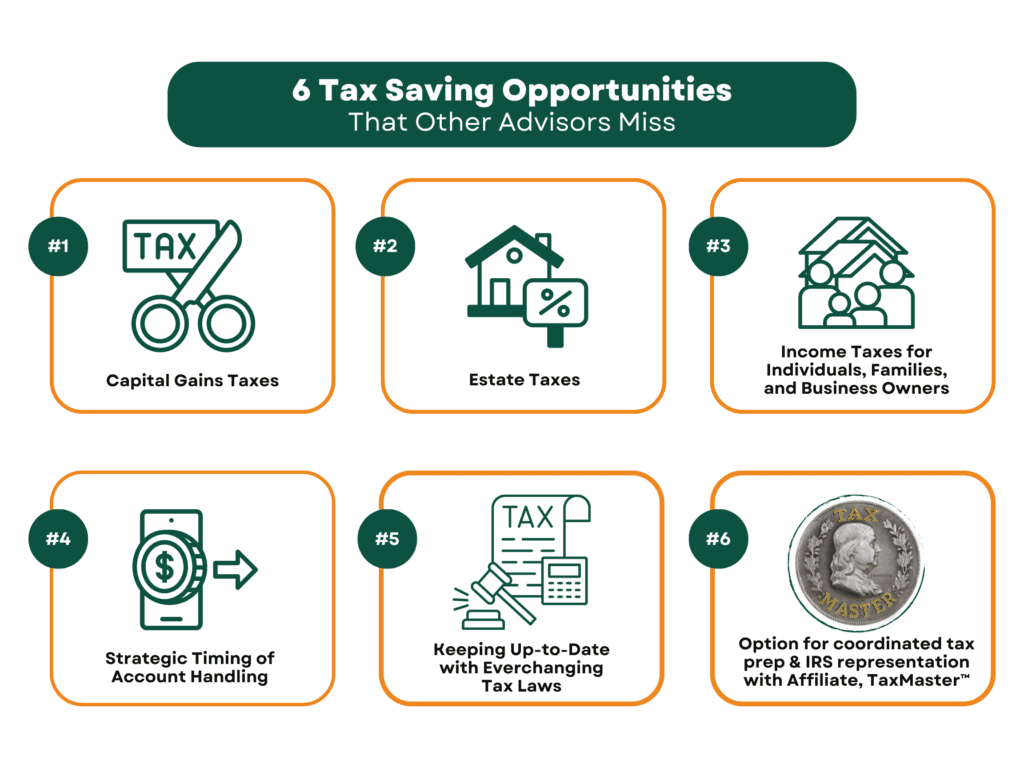

While investor opportunities vary, smart strategies can dramatically reduce or even eliminate capital gains, estate, income, and many other taxes.

Smart tax is magic. However, finding and identifying smart tax advice can seem impossible. At Camarda Wealth, we not only have advanced tax expertise in-house but include tax advice in our standard service. You can even choose to hire our common ownership affiliate, TaxMaster TM for tax returns preparation and other tax services, for an even greater level of coordination and ease for you.

Connect With Us

*Gunderson, Garrett B. (9 Jun 2015). Entrepreneurs: Stop Overpaying on Taxes. Forbes. https://www.forbes.com/sites/groupthink/2015/06/09/entrepreneurs-stop-overpaying-ontaxes/?sh=5654ae353f70https

Gardner, Diane. (2015). Stop Overpaying your Taxes: 11 Ways Entrepreneurs Overpay and How to Stop it Now! Biz Success Publishing.

U.S. Government Accountability Office. (29 Mar 2002). Tax Deductions: Further Estimates of Taxpayers Who May Have Overpaid Federal Taxes by Not Itemizing. United States General Accounting Office. https://www.gao.gov/products/gao-02-509

Ramsey Solutions. (3 Mar 2023). How to Get Your Cash Back if You’ve Overpaid the IRS. Ramsey Solutions. https://www.ramseysolutions.com/taxes/how-to-get-your-cash-back-overpaid-irs

Willey, Bruce. (29 Mar 2019). Entrepreneurs Pay Too Much in Taxes Because They Don’t Do This.

Kiplinger. https://www.kiplinger.com/article/business/t055-c032-s014-entrepreneurs-who-do-thispay-too-much-in-taxes.html

Roth Conversion – Target more Tax-Free Retirement Income with Camarda’s ROTHstimate™ Process

Working with your chosen tax preparer, Camarda can help explore your opportunities to convert IRAs, 401ks, 403bs, and other taxable retirement assets to TAX-FREE Roth accounts at lower or no tax costs using Dr. Camarda’s approach, which he describes as “the art of using tax arbitrage to convert taxable IRAs and 401ks to tax-free retirement income at zero or low tax cost.”

Overview:

-

-

-

- You deserve to use a sophisticated tax preparer – complex calculations

- Conversions before claiming Social Security give more flexibility

- A multi-year strategy – many variables that keep changing (including the law)

- You probably have more flexibility than you or your tax advisor know – learn it and use it!

- Properly executed is like creating money out of thin air – taxes saved is wealth earned!

- Conversion later in your when various numbers are more certain is safer

- Remember the 5-year rule – not tax-free until five years after 1st Roth contribution

-

-

Give Camarda a try and let us explore “smart tax” ways to convert avoidable tax into family wealth.