Proactive Portfolio Management & Growth

Why It Matters So Much

Many advisors are religiously buy-and-hold or have similar passive strategies that make no effort to get out of the way of major market meltdowns. But if you’re hit with a bear market in or near retirement, wealth can be erased forever. We think that can be a big mistake.

While the long-term trend for stocks has generally been up, severe downturns can damage wealth severely. If these downturns occur at the wrong time in your life – such as near or in retirement – your retirement lifestyle and estate legacy may never recover.

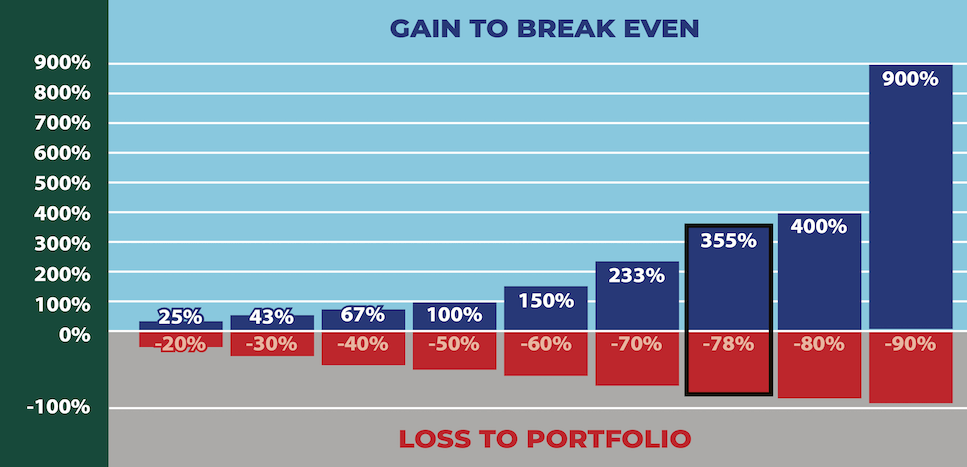

Consider the table below. If you suffered the loss in red, you’d have to make the gain in blue, just to break even.

That’s before taxes and inflation. Look at the NASDAQ 2000-2002 crash, outlined in black. Stocks dropped nearly 80% – and took fifteen years to make the 355% gain just to break even.

Disclosures:

*In the graph, the blue bars indicate how much you would have to make to overcome the loss indicated by the red negative bars underneath it. This is not to actually make any money, just to break even from the loss, and that’s before taxes and inflation! The bar outlined in black represents the NASDAQ crash of 2000-2002, when tech stocks plunged 78%, and did not recover for 15 years – and requiring a massive 355% gain to do so. After inflation, but before taxes and fees, that was 395% and 17 years…merely to recover in 2020 the wealth level lost in 2002.

**Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. Similarly, any references to indicators or other technical analysis tools or techniques are for educational or illustrative purposes only and results from example scenarios should be viewed as hypothetical. It should not be assumed that your Camarda account holdings correspond directly to any comparative indices or categories. Please also note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Camarda accounts; and (3) a description of each comparative your benchmark/index is available upon request.

Do you think that kind of gain is realistic? Could you wait that long?

We think protecting your wealth is too important to leave to chance in a random market. Our focus on shielding your portfolio separates us from the vast majority of “hang in there” buy-and-hold advisors. We offer a very different portfolio management solution.

“We study the markets on an ongoing basis, standing ready to trade quickly if indicated.”

The Total Wealth Care™ Camarda Difference

Camarda Wealth is a fiduciary investment advisor registered with the Securities and Exchange Commission. As a Federally regulated advisor, we serve clients across the United States.

Our common-ownership affiliate TaxMaster™ offers tax reduction planning, tax law research, and returns preparation, legal advice including trust design and documents, and other sophisticated non-securities wealth management services, also on a strictly fiduciary basis.

We’re proud to offer our credentialed expertise, pure fiduciary focus on your best interests, and suite of in-house wealth services – including portfolio, tax, estate/trust, and much, much more.

We’re glad you found us, and look forward to getting to know you.

Our objective? Managing your wealth to cut taxes and protect your portfolio, while targeting strong inflation-adjusted growth.