Proactive Portfolio Management No Matter the Market

Camarda’s investment philosophy is proactively managed hedged growth.

We seek to be proactive. We watch the markets closely and are prepared to move quickly when we deem it prudent to protect wealth and seize opportunity.

Unlike many other advisors, Camarda is not a “buy and hold” portfolio manager.

While the long-term trend for stocks has generally been up, severe downturns can damage wealth dangerously. Such downturns can sometimes last for a significant portion of the human lifespan.

If these downturns occur at the wrong time in your life – such as near or in retirement – your wealth may never recover. This is called “sequence of return” risk.

We think protecting your retirement, legacy and family wealth is simply too important to leave to “buy and hold” chance in a random market that may plunge dangerously at the wrong point in your life.

Our objective is to not only grow your wealth, but to preserve it and avoid big losses during the inevitable downturns.

That’s Wealth Done Right!™

Our Investment Philosophy

Technical Expertise To Protect Wealth & Drive Performance

Here’s a simplified example to demonstrate the potential of technical analysis. In actual practice, Camarda uses multiple indicators and data inputs to make portfolio management decisions.

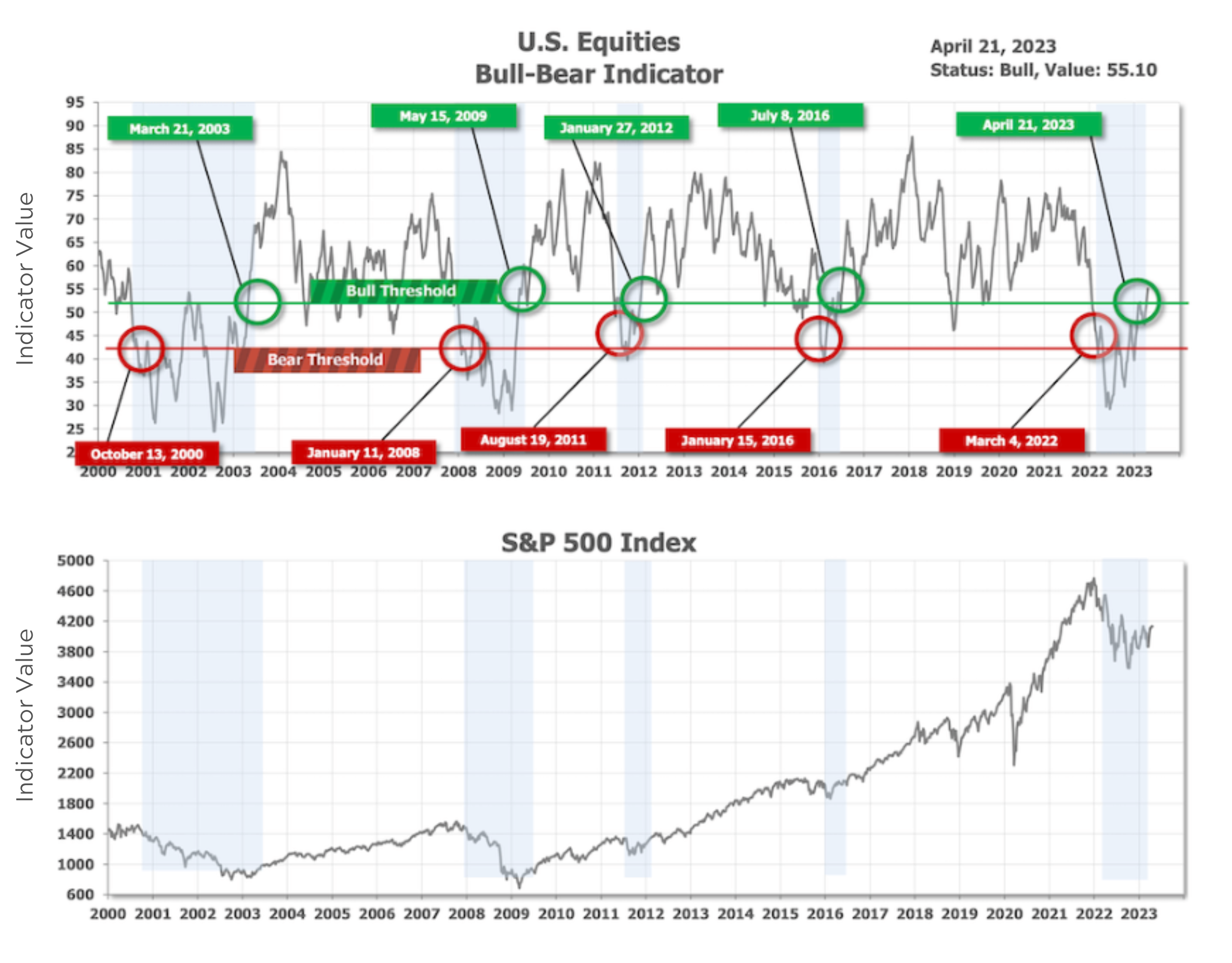

This indicator is called Bull-Bear and is intended to predict longer-term market changes. The indicator is the line on the top part of the graph, and the S&P 500 market index performance for corresponding times is the line on the part below. Recessions – major causes of bear markets – are the grey bars.

When the indicator breaks the red line on the way down, this is a sell signal. When it breaks green on the way up, it’s a buy signal.

Disclosures:

*Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. Similarly, any references to indicators or other technical analysis tools or techniques are for educational or illustrative purposes only and results from example scenarios should be viewed as hypothetical. It should not be assumed that your Camarda account holdings correspond directly to any comparative indices or categories. Please also note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Camarda accounts; and (3) a description of each comparative your benchmark/index is available upon request.

**The indicator referenced is provided by a third party, is provided on an “as is” basis, and the use of this information assumes the entire risk of any use made of this information. You should not make investment decisions based on this indicator. The Bull-Bear indicator was not followed by any actual portfolio during the timeframe represented. The chart shown is intended to help you understand how this particular investment strategy may have performed in the past if the strategy had existed or had been applied at that time. Performance was calculated after the end of the relevant period, allowing for the opportunity to adjust the strategy in hindsight. Camarda is not claiming to have utilized this indicator or strategy as represented herein in any of its portfolios, past or present. Limitations, including, but not limited to trading costs, execution efficiency, management fees, and taxes would have impacted results in various ways and it is not likely such performance would have been achieved as illustrated – actual results would likely have been better or worse. This is merely a hypothetical or “what if” example of what might have been attained to illustrate the concept. Performance shown for illustrative purposes is hypothetical and not linked to or representative of any portfolio.

The Bull-Bear Indicator is constructed from measurements of market internals and is intended to reveal the relationship of supply and demand at the longer-term timeframe of months to years. The measurements are ratios of supply and demand factors, normalized to a scale of 0 to 100. For example, the ratio of up-volume to (up volume + down volume) will always be in the range of 0 to 100, where the higher readings indicate a preponderance of demand (larger up volume) and lower readings they indicate a preponderance of supply (larger down volume). Other examples of ratios of supply and demand are advancers to (advancers + decliners) and new 52-wk highs to (new 52-wk highs + new 52-wk lows). There are 7 inputs in total, 5 of which are these supply and demand ratios, and 2 are pure price inputs. These inputs are continuously re-examined over a trailing one-year period, and the ratios are then weighted, and combined into a single, statistically smoothed final Bull-Bear Indicator. When the Bull-Bear Indicator is in a Bull Market mode and then pierces the Bear Market Threshold, a new Bear Market is signaled. When the Bull-Bear Indicator is in a Bear Market mode and then pierces the Bull Market Threshold, a new Bull Market is signaled. Once a mode (Bull or Bear) is established, it is considered to remain in place until the Bull- Bear Indicator eventually pierces the opposite threshold. In the graph represented, the Bull-Bear Indicator rotates to a bond index fund during out-of-market periods.

***Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Camarda, or any non‐investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Camarda.

You can see the S&P performance below after each signal. The signal requires a confirmed up or down trend before it appears, so capturing absolute market tops or bottoms this way is unrealistic. Still, the signal has the potential to avoid significant losses and capture much alpha – to get out of the way of big downtrends, but still benefit from most of the uptrends.

“We study the markets on an ongoing basis, standing ready to trade quickly if indicated.”

Connect With Us

Our objectives? Making moves to attempt to avoid losses and safeguard your portfolio, while targeting attractive holdings to fuel strong portfolio growth.