As we approach the end of another year, it’s crucial to take stock of your financial landscape and ensure you’re set up for success in the coming year. Your financial well-being is a puzzle with many pieces, and overlooking any one of them could impact your overall financial picture. To guide you through this process, we’ve crafted a comprehensive end-of-year financial checklist AND a start-of-the-year checklist designed to cover all bases and set you on the path to financial prosperity in the new year.

Ready to optimize your financial strategy? Click the first button below to uncover the key issues you should consider right now.

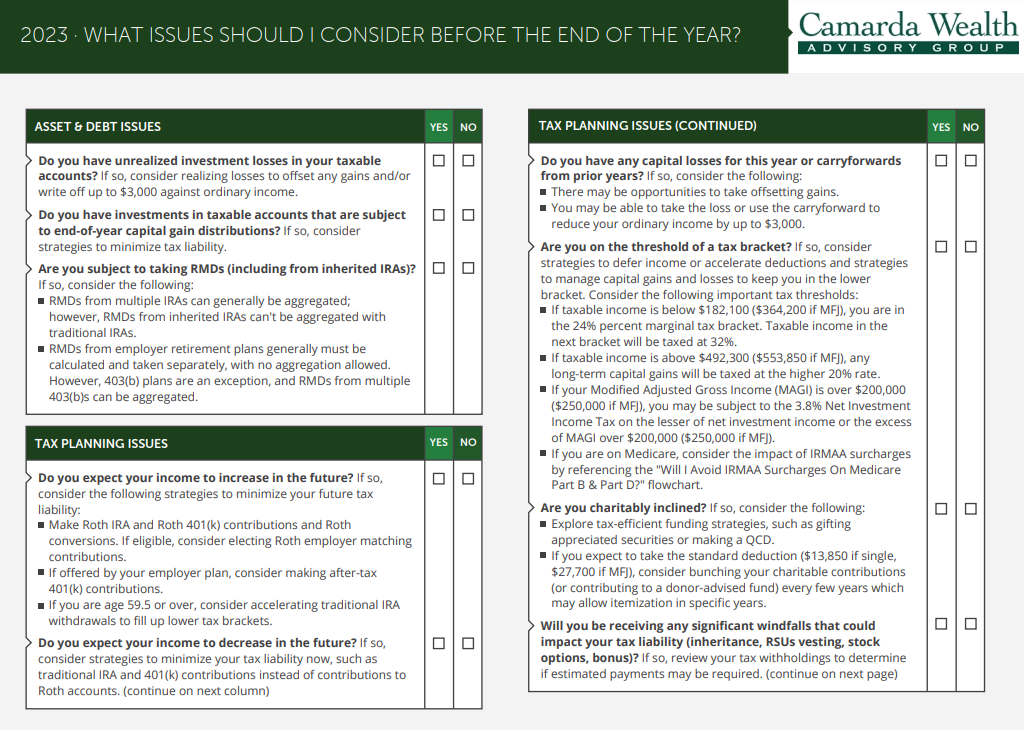

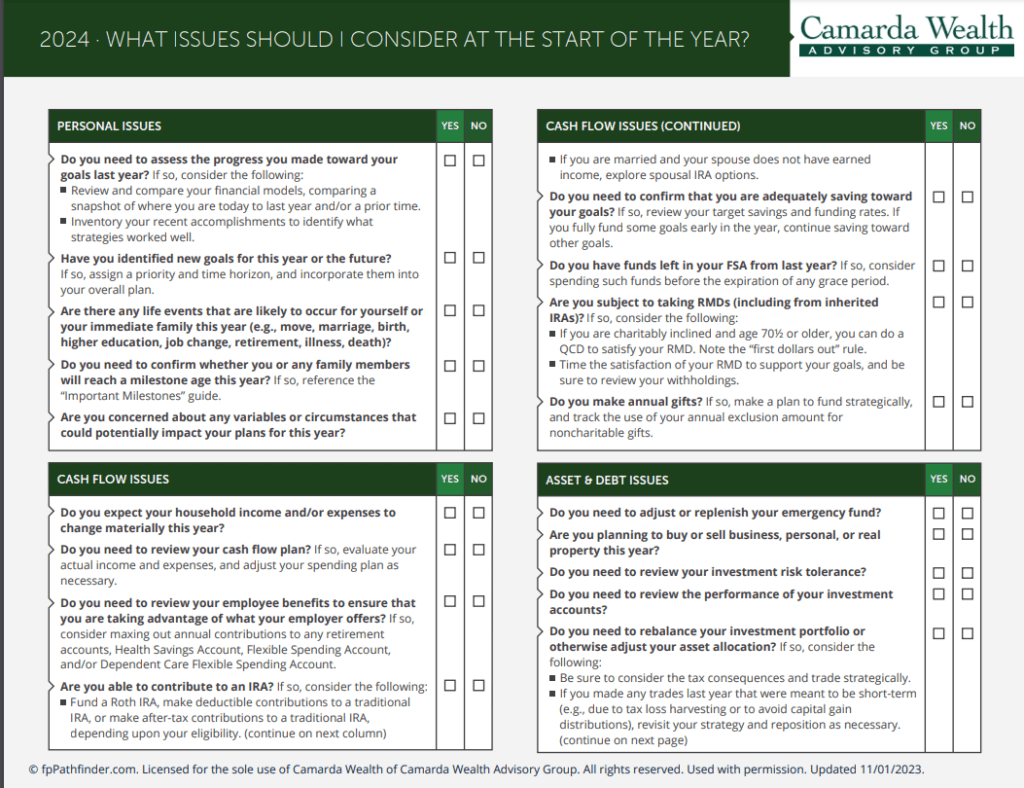

Issues Covered:

-

Asset & Debt

-

Tax Planning

-

Estate Planning

-

Insurance & Legal Issues

-

Cash Flow, Personal Issues, & More

Whether you’re a seasoned investor or just starting your financial journey, this checklist is tailored to help you make informed decisions, secure your financial future, and navigate the complexities of the ever-changing economic landscape. Let’s dive in and make the most of the opportunities that lie ahead!

And if you are serious about reaching your financial goals and finally getting the SMART advice your portfolio NEEDS, let’s connect!

What is included in this FREE Strategy Call?

We offer this free 15-30 minute Strategy Call as an introduction to what our experts believe to be the best strategies to grow your wealth health. If you are searching for help in reaching any of your financial goals for 2023 and beyond, we encourage you to take advantage of our highly-specialized Wealth and Asset Management Team’s insight on your unique needs with this private, no-obligation video call.

What is a Portfolio Stress Test?

During your Strategy Call, our team will review your portfolio with a Stress Test to scope out any possible hidden fees or commission products and grade your holdings alignment with your family’s goals. We will discuss your goals, review your options, give you personalized advice, and answer questions.

Will we be a match? What does the typical Camarda Wealth client look like?

Camarda has proudly served individuals and families since 1993. Our clients range from “millionaire next store” folks to quite wealthy families with complex estate, tax, asset protection, and other planning needs. Typically, they are retirees, professionals, and executives close to retirement, and business owners- past and present.

We offer this Portfolio Stress Test and Strategy Call for free and with no obligation so both parties can see how we match. We are a Fee-Only Fiduciary Firm, which means you will ALWAYS know what you are paying for up-front and honest- no commissions EVER! If you’re ready for expert advice, reply or click now to connect!